|

The respective Presidencies of Equatorial Guinea and Cameroon have signed a bilateral cooperation agreement, unlocking a new phase of energy security and economic expansion on the back of gas monetization and cross-border collaboration

|

|

JOHANNESBURG, South Africa, March 20, 2023/ — H.E. Teodoro Obiang Nguema Mbasogo, President of the Republic of Equatorial Guinea and H.E Paul Biya, President of the Republic of Cameroon have signed a bilateral treaty that would see the two West African countries cooperate on cross-border oil and gas development and monetization. The agreement was signed during the heads of state summit of the Economic and Monetary Community of Central Africa (CEMAC) countries held in Cameroon last week and is set to bring with it new opportunities for oilfield development and regional energy security. The African Energy Chamber (AEC), as the voice of the African energy sector, celebrates and supports the signing of the bilateral treaty between Equatorial Guinea and Cameroon. The Chamber is confident that the agreement will unlock a new era of cooperation, with the agreement serving as a blueprint for other African countries looking at strengthening knowledge sharing, skills and technology transfer, infrastructure development and local content, all on the back of cross-border oil and gas maximization. As such, the AEC urges the Governments of Equatorial Guinea and Cameroon to move fast, leveraging the treaty to fast-track field development, address fiscal challenges and bring new supplies on the regional market. For its part, the agreement paves the way for the joint development and monetization of cross border hydrocarbon fields, and more specifically, the Chevron-operated Yoyo (Cameroon) and Yolanda (Equatorial Guinea) oil and gas fields, which are located along the maritime borders of the two countries. Following Chevron’s acquisition of Noble Energy in 2020, the energy major has been committed to developing the promising fields, seeking to acquire a gas sharing agreement for the Yoyo and Yolanda discoveries with the aim of fast-tracking resource development. The bilateral agreement is set to not only aid in the field’s development, with the two states now set to progress to the Unitization Agreement of the Yolo-Yolanda field and the various monetization options, but in the development and launching of various other fields. Notably, the development of Cameroon’s Etinde gas field – operated by New Age – and Equatorial Guinea’s Camen and Diega fields are also set to be incorporated in the treaty, thereby maximizing the implementation of the Gas Mega Hub – an Equatorial Guinea initiative which aims to optimize the development and monetization of stranded offshore gas reserves in regional basins – and bringing long-term energy security and affordability benefits as well as gross domestic product growth for the two countries. The two countries’ success in achieving this milestone of signing the bilateral treaty can be largely attributed to the efforts undertaken by an integrated team led by the National Hydrocarbons Corporation of Cameroon and Equatorial Guinea’s Ministry of Mines and Hydrocarbons. The agreement itself is set to kickstart the joint development of the countries’ vast energy resources, with oil and gas industry growth inevitable on the back of improved cooperation between Cameroon and Equatorial Guinea. However, the treaty represents just the start, with several challenges including restrictive foreign exchange regulations implemented by the Bank of Central African States (BEAC) that continue to deter foreign investment in need of addressing. In this regard, the AEC urges further collaboration between the two countries towards improving the enabling environment for investment so that progress seen with the signing of the treaty is not only maintained but accelerated. “The Chamber commends the move made by Equatorial Guinea and Cameroon to unite on oil and gas resource development and exploitation. We believe that cooperation among African countries is key for driving the development and monetization of hydrocarbon resources to address looming energy access and affordability issues across the continent. We are confident that cooperation between Cameroon and Equatorial Guinea will unlock long-term economic benefits for the entire region,” states NJ Ayuk, the Executive Chairman of the AEC, adding that, “What we need to see now is consolidated efforts by all West African countries to address regulations that continue to deter investment, thereby putting in place enabling environments that trigger further growth across the energy sector. Policies such as those implemented by BEAC continue to limit growth.” Concluded Ayuk The AEC urges the Cameroonian and Equatorial Guinean governments to expand their cooperation even further to address business challenges caused by the BEAC regulations. Unless address, these regulations will continue to restrict the flow of foreign investments, the development of hydrocarbons as well as employment creation and market growth across the CEMAC region. Leveraging already existing partnerships such as the recently signed treaty, Equatorial Guinea and Cameroon have the chance to set a precedent across West Africa, with energy cooperation representing the first step towards long-term and sustainable economic growth. Distributed by APO Group on behalf of African Energy Chamber.

SOURCE |

Equatorial Guinea, Cameroon Bilateral Agreement Signals New Era of Cross-Border Cooperation in Africa

Tackling Poverty and Inequality in Southern Africa through people-centred recovery and resilience to global shocks

Southern Africa needs to, “build resilience in the energy and food security sectors, as well as finance, integral to its path to recovery and transformation towards reducing inequality and vulnerability”, says Mr. Jorge Jairoce, Permanent Secretary for Industry and Commerce, Mozambique, and Chair of the 28th Bureau of the Intergovernmental Committee of Senior Officials and Experts (ICSOE) for Southern Africa.

He was speaking in his capacity as Chair of ICSOE, at the dialogue for the Southern Africa region organized by the Economic Commission for Africa, Sub-Regional Office for Southern Africa (ECA SRO-SA) on the theme of the 2023 Conference of African Ministers of Finance and Economic Planning, “Fostering recovery and transformation in Africa to reduce inequalities and vulnerabilities”. The event provided a platform to socialize the issues paper to be presented for discussion at the Conference to be held from 15 to 21 March 2023 in Addis Ababa, Ethiopia. The paper presents the status of poverty and inequality in Africa in the context of overlapping global shocks and outlines compounding factors as well as promising opportunities for African countries to pursue a people-centered recovery.

Mr. Jairoce said that to tackle inequalities “the region requires bold and decisive actions. There must be clear commitment and cooperation of governments, civil society, the private sector, and international partners. This will obviously not be easy, but with determination and a shared vision, we can make progress towards a more just and equitable future for all”.

At the same event, Ms. Eunice Kamwendo, Director of the ECA SRO-SA encouraged member States in Southern Africa to use the dialogue as an opportunity to address issues of inequality in the region while acknowledging that most countries continue to face high public debt and increasingly constrained fiscal space. She said there was a need to take advantage of opportunities that global geopolitical and climate shocks present to Africa to come up with a “more people-centered recovery that could benefit current and future generations” She cited the African Continental Free Trade Area (AfCFTA) agreement, green investments, digital transformation and reforms to the global financial architecture as some of these opportunities.

She noted that, “Southern Africa is marked by high rates of income inequality. The Gini coefficient shows that in the whole world only 11 countries score above 50 on the Gini coefficient, and 8 of these 11 countries (Angola, Botswana, Eswatini, Mozambique, Namibia, South Africa, Zambia, Zimbabwe) are in Southern Africa – which makes our region the most unequal”.

During the dialogue participants from the Southern African countries shared national experiences on fostering recovery and transformation to reduce inequalities and vulnerabilities as crises continue unabated. Mr. Tayani Banda from the Malawi National Planning Commission informed the meeting that his country is focusing on wealth creation, not just poverty reduction, through social reforms, consolidated social transfer policies, financial inclusion, digital economy, livestock policies and an industry-based domestic strategy that is anchored on youth development and contributes to Malawi 2063 Vision. Dr Nation Bobo from Zimbabwe spoke about how the AfCFTA agreement could be harnessed to increase economic resilience, inclusion and reduce vulnerability, saying the agreement will improve citizens’ living standards because of its expected economic development and growth benefits.

In her closing remarks, Ms Isatou Gaye, chief of sub-regional initiatives’ section at the ECA SRO-SA, reiterated ECA’s commitment to continue supporting member States’ economic recovery efforts and help transform the region for better developmental outcomes through concrete actions to promote regional integration and inclusive industrialization.

Effective AfCFTA implementation will boost Africa’s economy and global competitiveness

Acting Executive Secretary of the Economic Commission for Africa (ECA), Antonio Pedro, has urged African nations to accelerate implementation of the African Continental Free Trade Area (AfCFTA) in order to become more resilient and globally competitive.

“Only through an accelerated and effective implementation of the AfCFTA can Africa build sufficient shock absorbers to build resilience,” said Mr Pedro in his remarks at the 42nd Ordinary Session of the African Union Executive Council meeting in Addis Ababa on February 15, 2023.

Launched in 2019 to establish a unified market of 1.3 billion people and a GDP of around US$ 3.4 trillion, the AfCFTA is poised to become the world’s largest free trade area with 55 member states.

Mr Pedro deplored the fact that the COVID-19 pandemic and the Russia–Ukraine war have caused a state of crisis, pushing 55 million people below the poverty line and exacerbating inequalities.

High global inflation has also led to tighter financial conditions. Mr Pedro said despite Africa’s economic growth of 3.9% in 2023 and 2024, more still needs to be done to compensate for the losses experienced in the past three years.

The Acting Executive Secretary pointed out that by fast-tracking the implementation of the AfCFTA, Africa can provide solutions to the global challenges of supply chain disruptions, food insecurity, climate change, and migration.

Highlighting that the AfCFTA provides the economy of scale to invest in manufacturing and increased intra-Africa trade, Mr. Pedro said the free trade area would bring supply chains closer to home and inject self-sufficiency in essential products such as medicines, food and fertilizers.

“By providing more opportunities for women and the youth, the AfCFTA helps reduce inequality and poverty, and improves inclusion,” he said.

However, Mr Pedro highlighted two challenges that require immediate attention – ratification and implementation – and appealed to the ten African countries that have not yet ratified the agreement to do so soon.

Commenting on resource-based industrialization, Mr Pedro said this should focus on value addition, smart operationalisation of local content policies, and tapping into global value chains.

He cited the Battery and Electric Vehicle (BEV) sector as one that could enable the continent to tap into a global value expected to reach US$8.8 trillion in the next three years and US$46 trillion by 2050. The ECA is supporting BEV value chain with “strong political will from the Democratic Republic of Congo and Zambia,” said `Mr Pedro.

ECA is also partnering with stakeholders to support the transboundary agro-industry park and special economic zone involving Zambia and Zimbabwe, which could address food security concerns and tap into Africa’s food import market valued at about US$90 billion per year.

Mr Pedro pledged ECA’s continued support and collaboration with the African Union and other stakeholders to transform Africa into a globally competitive investment destination.

SOURCE United Nations Economic Commission for Africa

Africa leads the charge in tackling battery waste

The principles of a circular economy increase access to cleaner energy

The key message from COP27 was the importance of supporting the global south as the area continues to suffer the effects of the climate crisis more severely than the global north.

It is well understood that reducing waste is one of the key routes to avoiding an environmental crisis, but as the world transitions to clean energy sources, batteries and energy storage systems are increasingly in demand – and the issue of battery waste runs the risk of negating the positive effects of the clean energy transition.

Dr Amrit Chandan, CEO and co-founder of cleantech firm Aceleron, predicts that the number of batteries that will need to be disposed of by 2040 would fill Wembley Stadium 23 times every single year, with ten times that number already in circulation today.

“The world has a lot to learn from Africa on this subject, as the continent has adopted a number of initiatives that tackle the issue of battery waste whilst increasing access to a reliable, renewable power supply that also helps to improve prospects for entire communities.” says Chandan.

Aceleron has designed and built a unique circular economy battery technology that enables their batteries to be taken apart, down to a single cell, for repair, maintenance and upgrade. In comparison to traditional batteries, where, if one part fails, the entire product goes to waste, this new approach means that a single part can be swapped out for a working or updated replacement and the battery in its entirety can continue to fulfil its purpose.

This serviceable battery model has the power to dramatically reduce battery waste, as well as ensure that the maintenance, servicing and upgrade can be carried out locally, creating jobs and reducing travel emissions at the same time.

Project BATLAB – the first ever containerised battery service hub

The BATLAB, a joint project between Venture Engineering, Total Group, The Shell Foundation and Aceleron is a self-sustaining battery servicing container, powered entirely by solar PV.

It allows for products containing batteries that no longer work to be safely repurposed by trained local labour into battery packs that can be used by the local population to meet their energy needs – from charging a mobile phone to providing lighting or refrigeration. The BATLAB has all the components to build, repair, upgrade and, in some cases, monitor every battery in one place throughout its entire lifecycle. Once the battery finally reaches the end of its useful life, it can be returned to the BATLAB for repurposing or recycling.

This creates jobs, supports livelihoods and provides opportunities to keep the materials used to make batteries in circulation for as long as possible.

The first BATLAB has been deployed in Bidibidi refugee settlement in Uganda, which is run by the International Organisation for Migration (IOM), where local staff have been fully trained and supported to handle the batteries safely.

Reida Kiden, who works in the BATLAB in Uganda said: “I am very excited by the BATLAB’s arrival in the Bidibidi settlement and am grateful for the opportunity to work and learn from the team responsible for it. I know it will change lives for the refugees who are based in the camp here in Uganda.”

Chandan adds; “We can see this BATLAB blueprint project becoming a crucial piece of the wider battery puzzle – particularly in emerging markets, where easy access to hi-tech facilities and equipment is limited. This gives it the potential to play a key role in underpinning a wider net zero transition.”

Mobile mini-grids in Kenya

Last year, off-grid communities in Kenya benefited from the successful development and trial of mobile mini-grids that are able to provide power from a centralised power source to whole villages on the days when it is needed most. For instance, the mini-grid can be used to power agricultural equipment such as milling machines ahead of market day, saving on labour and speeding up the crop’s journey from field to market.

The mini-grid project consists of a portable trailer with 10kW of rapidly deployable solar panels and 20kWh of lithium-ion battery storage which can be serviced and maintained on the ground. The project is being delivered jointly by Kenyan social enterprise Chemolex, clean technology company Aceleron and Smart Villages Research Group (SVRG) and has been funded by Innovate UK’s Energy Catalyst programme.

Scalable mini-grids in Sierra Leone

In order to consistently and reliably deliver power to Kukuna Health Centre in Sierra Leone, a new battery bank works with a solar PV system to deliver power no matter the time of day or night. This means that the 15,000 patients the clinic serves will be treated safely and consistently; patients can give birth safely at night, the vaccine cold chain will remain unbroken and staff will have access to the power they need to meet any medical emergencies, 24 hours a day.

The scalable system allows for more batteries to be added over time so, as the community thrives and demand for power naturally increases, it will simply be a matter of adding more batteries to expand the amount of power available at any given time.

The project came to fruition via a partnership between Vittoria Technology, Aceleron and Energicity and was funded by Innovate UK’s Energy Catalyst programme, which also funded the mobile mini-grid initiative in Kenya.

Chandan explains why Africa is spearheading the transition to greener, cleaner and more sustainable energy; “Africa has a large off-grid population and an abundance of solar energy so it makes sense that innovations in battery energy storage are rapidly developing across the continent.

“Many African countries dispose of unwanted batteries using an open-smelting method, which is often the only solution to dealing with the waste. This leads to the emission of toxic materials and carcinogenic smoke which can contaminate the local ecosystem and is harmful to the local people.

“Projects such as these not only increase access to energy, they also increase access to genuinely sustainable, renewable power sources that can work flexibly to meet the different needs of a community, whether that’s to get crops to market before they spoil, provide life saving treatment or improve transport links in rural areas.

“The rest of the world will undoubtedly learn a lot from Africa as it reduces waste and increases access to renewable energy in order to empower communities to prosper and thrive – without relying on outdated and expensive fossil fuels.”

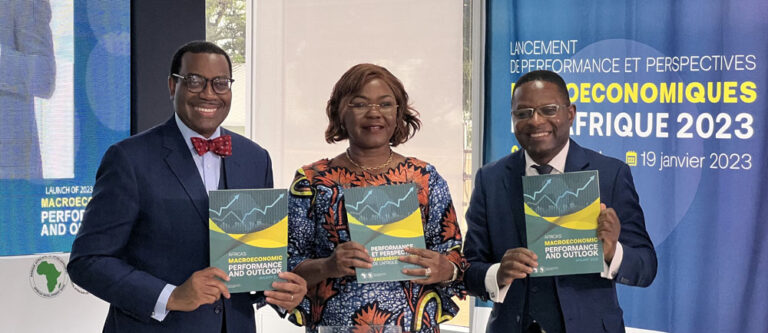

Africa’s economic growth to outpace global forecast in 2023-2024 – African Development Bank Biannual Report

|

African Development Bank’s new report calls for bold policy actions to help African economies mitigate compounding risks

|

|

Africa is set to outperform the rest of the world in economic growth over the next two years, with real gross domestic product (GDP) averaging around 4% in 2023 and 2024.

This is higher than projected global averages of 2.7% and 3.2%, the African Development Bank Group said in Africa’s Macroeconomic Performance and Outlook (http://bit.ly/3iLJF4C) report for the region, released in Abidjan on Thursday. With a comprehensive regional growth analysis, the report shows that all the continent’s five regions remain resilient with a steady outlook for the medium-term, despite facing significant headwinds due to global socio-economic shocks. It also identified potential risks and called for robust monetary and fiscal measures, backed by structural policies, to address them. The Macroeconomic Performance and Outlook report will be released in the first and third quarters of each year. It complements the bank’s existing annual African Economic Outlook (http://bit.ly/3lMe67I) report, which focuses on key emerging policy themes relevant to the continent’s development. The report shows that estimated average growth of real GDP in Africa slowed to 3.8% in 2022, from 4.8% in 2021 amid significant challenges following the Covid-19 shock and Russia’s invasion of Ukraine. Despite the economic slowdown, 53 of Africa’s 54 countries posted positive growth. All the five regions of the continent remain resilient with a steady outlook for the medium-term. However, the report sends a cautionary note on the outlook following current global and regional risks. These risks including soaring food and energy prices, tightening global financial conditions, and the associated increase in domestic debt service costs. Climate change—with its damaging impact on domestic food supply and the potential risk of policy reversal in countries holding elections in 2023—pose equally challenging threats. The report advocates bold policy actions at national, regional, and global scales to help African economies mitigate the compounding risks. In remarks during the launch, African Development Bank Group President Dr. Akinwumi Adesina said the release of the new report came at a time when African economies, faced with significant headwinds, were proving their resilience. “With 54 countries at different stages of growth, different economic structures, and diverse resource endowments, the pass-through effects of global shocks always differ by region and by country. Slowing global demand, tighter financial conditions, and disrupted supply chains therefore had differentiated impacts on African economies,” he said. “Despite the confluence of multiple shocks, growth across all five African regions was positive in 2022—and the outlook for 2023–24 is projected to be stable.” Niale Kaba, Minister of Planning and Development of Côte d’Ivoire, said: “The release of this report by our bank, the African Development Bank Group, at this time of the year is an excellent opportunity for Africa and its global partners. We need these regular updates to assess our countries’ macroeconomic performance and prospects. This reliable information will help decision-making and risk management for potential investors in Africa.” Africa’s pre-Covid-19 top five performing economies are projected to grow by more than 5.5% on average in 2023-2024 and to reclaim their position among the world’s 10 fastest-growing economies. These countries are Rwanda (7.9%), Côte d’Ivoire (7.1%), Benin (6.4%), Ethiopia (6.0%), and Tanzania (5.6%). Other African countries are projected to grow by more than 5.5% in the 2023-24 period. They are the Democratic Republic of Congo (6.8%), The Gambia (6.4%), Mozambique (6.5%), Niger (9.6%), Senegal (9.4%), and Togo (6.3%). At the launch, economist Jeffrey Sachs, Director of the Center for Sustainable Development at Columbia University commended the report which he said showed that African economies are growing and growing consistently. Sachs, who is also United Nations Secretary-General Antonio Guterres’ Advocate for Sustainable Development Goals, said: “Africa can and will rise to growth of 7 percent or more per year consistently in the coming decades. What we’ll see, building on the resiliency we see in this report, is a real acceleration of Africa’s sustainable development so that Africa will be the fast-growing part of the world economy. Africa is the place to invest.” Bold policy actions to help African economies mitigate the compounding risks The report advocates robust measures to address the risk. These include a mix of monetary, fiscal, and structural policies including:

Overview of economic outlook across regions Despite the confluence of multiple shocks, growth across all five African regions was positive in 2022—and the outlook for 2023–24 is projected to be stable.

In his presentation, African Development Bank Acting Chief Economist and Vice President Kevin Urama observed that Africa is still a favorable destination for investments in human capital, infrastructure, private sector development, and natural capital. Urama said: “Africa has a significant role to play in driving inclusive growth and sustainable development globally. There are many smart investment opportunities in key sectors: agriculture, energy markets, minerals, health infrastructure and pharmaceutical industries, light manufacturing, transport and logistics, digital economy and more. The continent remains a treasure trove for smart investors globally.” For more information and to download the report, click here (https://bit.ly/3iLJF4C). Distributed by APO Group on behalf of African Development Bank Group (AfDB).

Media Contact: About the African Development Bank Group: SOURCE |

End Energy Colonialism and Let Africa Make its Choices on Natural Gas at Conference of the Parties (COP27) – African Energy Chamber

900 million Africans rely on solid biomass such as firewood and charcoal for cooking, which causes indoor pollution that kills 600,000 people a year

JOHANNESBURG, South Africa, November 16, 2022/ — Let’s look at African realities

A kettle boiled twice a day by the rich and luxurious family of radical leftist group Extinction Rebellion’s (http://bit.ly/3GrFAM2) Chloé Farand in the France, uses five times as much electricity as an entire Malian family uses per year.

900 million Africans rely on solid biomass such as firewood and charcoal for cooking, which causes indoor pollution that kills 600,000 people a year. On average, a Tanzanian would take 8 years to consume as much electricity as Chloé Farand consumes in one month.

Sub-Saharan Africa has undiscovered, but technically recoverable, energy resources estimated at about 115.34 billion barrels of oil and 21.05 trillion cubic metres of gas. We have to use our natural gas to fix Africa’s problems. Chloé Farand needs to decarbonize and Bola, Aderike, Abosede, Atinuke Omolade and Oyinola need to have electricity, clean cooking, jobs and industrialization. And we need to use African natural gas to do that. Except you believe like many in Chloe Ferand’s camp do, that Africans do not deserve reliable and affordable power just like they have in Europe.

Environmental Concerns

While environmental causes are a major focus in the West, lawmakers in Africa’s developing countries are more concerned with living wages and supplying basic necessities to the continent’s growing population.

The plan of radical western activists like Chloé Farand who often pretend to be journalists to hide their murky anti-Africa agendas and Extinction Rebellion would amount to austerity measures in Africa that would see Africans leaving petroleum resources in the ground that has benefitted Farand and generations of her family for hundreds of years, in exchange for poverty for Africans. Her parents colonized us and took everything and today she essentially brands poor Africans criminals — or at the very least enemies of the environment — for using fossil fuels. We just saw it with the recent hit job and attacks on Africans at COP27.

Africa’s natural gas sector will soon be responsible for large-scale job creation, increased opportunities for monetization and economic diversification, and critical gas-to-power initiatives that will bring more Africans reliable electricity. These significant benefits should not be dismissed in the name of achieving net zero emissions on deadlines set by Farand, her ilk and people who only know Africa from TV, Halloween parties and the odd exotic trip abroad. To tell African countries with gas potential like Mozambique, Tanzania, Equatorial Guinea, Nigeria, Senegal, Libya, Algeria, South Africa, Angola and many others that they can’t monetize their gas and rather wait for foreign aid and handouts from their western counterparts makes no sense. At the same time, Farand and her family in France and the UK continue to enjoy power from the same gas they deny Africans, as well as coal and other forms of hydrocarbons.

What’s more, we can’t overlook the fact that renewable energy solutions are still young technologies —they are less reliable and more expensive per unit of power than other tried-and-tested sources of base load, including hydrocarbons. Achieving net zero by 2050 would therefore require that Farand focus her advocacy on her family and her neighbors rather than pick on poor Africans.

Banning African Natural Gas Production

A ban on African natural gas production would bring about the collapse of many carbon-dependent governments in Africa. The oil industry is the primary source of income for many African nations. Without the continuation of petroleum production — or time and opportunities to cultivate new revenue sources — their economies will suffer — along with their citizens.

Fossil Fuel executives should be at COP27. We have maintained in the past and continue to believe that demonizing energy companies and those that work in the oil and gas industry is not a constructive way forward and ignoring the role that carbon-based fuels have played in driving human progress distorts the public debate. Western countries are flat out wrong on this. They have benefited the most from Fossil Fuels. We are facing climate challenges today solely due to their historic pollution.

We cannot expect African nations, which together emitted seven times less CO2 than China last year and four times less than the US, according to the Global Carbon Atlas, to undermine their best opportunities for economic development by simply aligning with the Western view of how to tackle carbon emissions. At the same time, no western nation is ready to pay a fair price for their role in legacy carbon emissions

Outside Agitators at COP27.

Africans who attend COP27 are not outside agitators. Africans who work in the natural gas industry continue to be treated as outside agitators for daring to attend an African COP27 in Egypt. The nasty and vicious attacks from radical environmental groups such as extinction rebellion and their surrogates such as Chloe Farand who claim and pretend to speak in Africa’s best interest. Where and when were they elected to this these positions and by which Africans might we ask? A very rich white woman who does not understand the need to defeat black energy poverty. We are not surprised by the racist undertones of their advocacy, given that her Orgarnisation do not hire or recruit black people. Maybe she can start by hiring some token blacks. She has refused to provide documentation on her funding for such anti-black and African activities. She plagiarized a discredited and debunked story to attack Africans. Sounds familiar.

Black people who are fighting energy poverty in Africa must understand that they will continue to be attacked by vested anti-African interests, many of which often pretend to be pro-African. They will face situations like that of African Americans fighting for civil rights in the 60s. Segregationist Alabama Governor John Patterson for example refused to condemn white rioters, and instead blamed the Freedom Riders for the violence they suffered in Alabama at the hands of white rioters who used similar language like we see being used today against African anti-energy poverty advocates; trouble makers, charlatans, fraudsters, looters, corrupt, terrorists etc.

Patterson had warned that integration would cause “violence, disorder, and bloodshed” and had refused to repudiate an endorsement from the Ku Klux Klan. “If the Federal Government really wants to help in this unfortunate situation,” Patterson told reporters in Montgomery, “they will encourage these outside agitators to go home. We have the means and the ability to keep the peace in Alabama without any outside help.”

White opposition to black energy poverty was largely a quiet movement that has now become the rallying cry of the climate movement. Africans need to pay attention to this. When they attack your beloved African Energy Chamber and anyone associated with it, it is because our work is picking up steam and they need to silence our voices. We will not be silenced by people who live in houses that use coal, use gas to drive their cars, use diesel to power their economies and then lecture Africans that they need to stay in the dark and be happy for it for the sake of our environment. A very white colonialist agenda.

China and Africa

While extinction rebellion and others are calling for a ban on investment in African oil and gas, China, meanwhile, appears willing to continue investing in fossil fuel projects in Africa. This means that to keep their nations energized, African governments will have little choice but to partner with China.

This generation of Africans have a battle on their hands. Like Nkrumah, Mandela, Sankara, Garvey, King, Ahmed Ben Bella, Malcolm and Winnie Madikizela Mandela, we will continue fighting these battles. We will push back harder; we will not let anyone silence and destroy the future of Africans. The God of our ancestors is with us and we are wearing the armor and winning the war.

Distributed by APO Group on behalf of African Energy Chamber.

Africa: Zimbabwe Open for Business, says President Mnangagwa

President Mnangagwa spoke on Thursday at a special event on the margins of the Africa Investment Forum Market Days 2022 in Abidjan, Côte d’Ivoire

Access Multimedia Content

ABIDJAN, Ivory Coast, November 4, 2022/ — “Private sector opportunities in Zimbabwe are limitless” – Zimbabwe President Dr. Emerson Mnangagwa; Agriculture will power our way to achieving vision 2030” – Anxious Masuka.

Zimbabwean President Dr. Emerson Mnangagwa has called on investors to realize the massive investment opportunities in Zimbabwe and shun negative perceptions of risk.

Zimbabwe, self-sufficient in food production and a major exporter of wheat, tobacco, and corn to the 14-member Southern African Development Community, to other African countries and the wider world before 2000, saw its exports plummet. Before 2000, farming accounted for 40% of all Zimbabwe’s exports. In 2010 though, it dropped to 2%.

President Mnangagwa spoke on Thursday at a special event on the margins of the Africa Investment Forum Market Days 2022 in Abidjan, Côte d’Ivoire. The event dwelt on the broad range of investment opportunities in Zimbabwe. Several cabinet ministers accompanied the president, namely Foreign Affairs Minister Frederick Shava, Finance and Economic Development Minister Mthuli Mcube, Agriculture Minister Anxious Masuka and Industry and Commerce Minister Sekai Nzenza.

“The focus is to persuade global capital assembled in this city to realize that there are opportunities for investment in Zimbabwe,” President Mnangagwa said.

The African Development Bank and its seven partners set up the Africa Investment Forum—Africa’s premier investment platform—to attract investment and capital to Africa. The forum’s Market Days 2022 which runs from the 2nd to 4th of November, feature boardroom sessions that promote flagship sectors where Africa has a comparative advantage. Examples are women-led businesses, music, film, fashion, textiles, and sports.

President Mnangagwa said African Development Bank President Dr. Adesina invited him to the forum when Adesina visited Zimbabwe earlier this year. Adesina agreed to champion Zimbabwe’s debt clearance strategy. Zimbabwe has been hurt by sanctions imposed by the European Union and other Western countries.

“Our mission here is to explain ourselves, assure investors that Zimbabwe is a safe investment destination,” President Mnangagwa said.

Adesina said Zimbabwe could count on the African Development Bank’s strong support. He confirmed the bank’s approval of a $4 million grant to support the development of a secretariat to move the country’s debt arrears clearance issue forward.

“I know the story of Zimbabwe, the opportunities and potential of Zimbabwe,” Adesina said. “I think Zimbabwe is not as risky as you think…Private sector opportunities are limitless.”

Adesina outlined the country’s many potential areas for investment, including steel, agriculture and information technology. He said the bank was lending support in these and other sectors.

The African Development Bank also made a grant to Zimbabwe during the Covid-19 pandemic, stepping in where other institutions had not.

“Zimbabwe is strongly committed… Zimbabwe will again be the breadbasket of Africa. I will swim right beside you,” he said.

President Mnangagwa’s ministers also spoke bullishly about Zimbabwe’s investment prospects.

Ncube said the Zimbabwe Investment and Development agency (ZIDA) was the country’s one-stop shop for potential investors. “With ZIDA, your investment is safe…we have the capacity…we are waiting for you,” the finance minister said.

Nzenza said the country was focusing especially on mining, agriculture, tourism and manufacturing, such as producing cotton, locally and lithium batteries.

“There’s no doubt that sanctions hurt, but Zimbabwe is open for business. The key words are value addition…we have been exporting raw materials we must manufacture,” Nzenza said.

Masuka said in his opinion, the biggest opportunity was the land reform program that Zimbabwe had embarked on. The government has put agriculture at the top of its agenda. “We want to develop agriculture…there are massive opportunities. Agriculture will power our way to achieving vision 2030,” Masuka said.

Private sector panelists at Thursday’s event were invited to offer advice to potential investors in Zimbabwe. They included Marjorie Mayida, managing director of Zimbabwe’s leading insurance company, Old Mutual; George Manyere, managing director of Brainworks a Zimbabwean company listed on the Johannesburg and London stock exchanges; Kalpesh Patel, managing director of SteelMakers Group of companies; and Peggy Mapondera, an investment principal at Masawara PLC, a pan-African diversified investment holding group.

George Manyere of Brainworks Ltd said Zimbabwe’s economic performance against neighboring countries like Zambia, Malawi and Mozambique—which do not have sanctions and enjoy support from the international lending community—was proof of the nation’s capacity to perform despite perceptions of risk, and the country’s biggest selling point.

Tshepidi Moremong, Chief Operating Officer of Africa50 noted the progress and opportunities in transport, logistics, infrastructure. She said that following a mission to Harare last month, Africa50 would be signing a memorandum of understanding, specifically on asset recycling.

Kapesh Pattel of SteelMakers Group advised that getting out in front of investors would help to demystify negative and misleading perceptions of Zimbabwe.

For the first time since the Africa Investment Forum began in 2018, three promising business transactions from Zimbabwe made it through to boardroom discussions during the Africa Investment Forum Market Days.

African Development Bank senior officials at the special side event included Director General for the Southern Africa region Leila Mokaddem, Zimbabwe Country Manager Moono Mupotola; and Kevin Urama, Vice President and Acting Chief Economist and Vice President for Economic Governance and Knowledge Management.

The Africa Investment Forum platform is an initiative of the African Development Bank and seven other development institutions: Africa 50; the Africa Finance Corporation; the African Export-Import Bank; the Development Bank of Southern Africa; the Trade and Development Bank; the European Investment Bank; and the Islamic Development Bank.

New report reveals Africa is facing a crisis in funding for climate adaptation

Africa is facing a critical shortfall in funding for climate adaptation according to a new report, State and Trends in Adaptation in Africa 2022 (https://bit.ly/3fvKTzk), launched by the Global Center on Adaptation (https://GCA.org/)

The report reveals that cumulative adaptation finance to 2030 will come to less than one-quarter of the estimated needs stated by African countries in their National Determined Contributions (NDCs) unless more funding for climate adaptation is secured.

In 2019 and 2020 an estimated $11.4 billion was committed to climate adaptation finance in Africa with more than 97% of the funds coming from public actors and less than 3% from private sectors. This is significantly less than the $52.7 billion annually to 2030 it is estimated African countries will need.

To increase the volume and efficacy of adaptation finance flows to Africa over the coming decade, the report makes a number of recommendations:

Financial institutions must mainstream resilience into investments they are making.

Policy makers and other stakeholders must build the enabling environment for adaptation investment.

Financial innovation for adaptation must match country-level policy and market conditions.

Professor Patrick Verkooijen, CEO of the Global Center on Adaptation, commenting on the report findings said:

“Adaptation finance is scaling too slowly to close the investment gap in Africa, even as the costs of inaction rise. As we look forward to COP27, we must generate a breakthrough on finance for climate adaptation. The Africa Adaptation Acceleration Program endorsed by the African Union, is the best vehicle we have to ensure the adaptation investment shortfall in Africa is met with action from all available sources including the private sector.”

Speaking during the launch event for the report, Amina Mohammed, Deputy Secretary-General of the United Nations said:

“COP27 must be a turning point. Developed countries must put forward credible plans to double adaptation finance to reach 40 billion dollars a year by 2025. The Secretary-General has called for a new business model to deliver adaptation finance by turning adaptation priorities into pipelines of investment for projects.”

Akinwumi Adesina, President of the African Development Bank Group said:

“At the Global Center on Adaptation, they are doing incredible work in mapping out what the needs are, mapping out how to make climate resilient infrastructure. Already the Upstream [Financing] Facility at the Global Center on Adaptation, is doing so much analytical work to support countries to build climate resilience into infrastructure, into agriculture and to mainstream climate financing into national bodies but also into the financing of large multilateral development banks.”

Josefa Leonel Correia Sacko, Commissioner for Rural Economy and Agriculture for the African Union Commission said:

“Africa’s 1.4 billion people contribute less than 3% of the world’s total greenhouse gas emissions but finds itself on the frontline of this climate emergency with nine out of ten of the most vulnerable countries in Africa. Adaptation to climate change is very crucial to Africa. At COP27 it is adaptation and financing adaptation which is our priority.”

STA22 provides policy shaping recommendations in key areas such as livestock, agriculture, cities, nature-based solutions, blue economy, and coastal erosion. It is the most comprehensive guide to assess progress on climate adaptation in Africa and provide guidance and recommendations on best practices in adapting to the effects of a changing climate and building resilience to climate shocks.

The report highlights successful adaptation initiatives from the Africa Adaptation Acceleration Program (AAAP) which have the potential to be scaled up and replicated. It also presents key policies, skills and finance gaps that must be addressed if adaptation is to be effective and reach those who need it the most.

Commenting on the report’s findings, Dr Ede Ijjasz-Vásquez and Professor Jamal Saghir, Co-Directors of State and Trends in Adaptation in Africa 2022 said:

The climate is changing rapidly and Africa needs to Adapt. It must adapt to rising temperatures, more extreme storms and floods, rising sea levels, more intense heatwaves and longer and more severe droughts. Our report maps out not only the impacts of climate change, but also the available adaptation solutions. The report proves that adaptation is an opportunity for jobs and economic recovery. Adaptation pays.”

The Africa Adaptation Acceleration Program (AAAP) was developed by African Development Bank and the Global Center on Adaptation (GCA) to mobilize $25 billion by 2025 to implement, scale and accelerate climate adaptation across the African continent. AAAP works across four bold interconnected pillars to achieve transformational results: Climate-Smart Digital Technologies for Agriculture and Food Security; African Infrastructure Resilience Accelerator; Youth Empowerment for Entrepreneurship and Job Creation in Climate Adaptation and Resilience and Innovative Financial Initiatives for Africa. AAAP has already guided over $3.5 billion of upstream investments in 19 countries with every dollar spent influencing $100 downstream.

Distributed by APO Group on behalf of Global Center on Adaptation (GCA).

Comoros: African Development Bank Provides Nearly €6 Million to Boost Food Production

The grant funds will come from the African Development Bank’s Transition Support Facility, a mechanism to help fragile African states

Access Multimedia Content

ABIDJAN, Ivory Coast, October 21, 2022/ — The Board of Directors of the African Development Bank Group (https://www.AfDB.org/) has approved a €5.76 million grant to the Comoros to increase food production and enhance the resilience of its food system. The move comes as the country has experienced rising food prices due to the war in Ukraine.

The grant funds will come from the African Development Bank’s Transition Support Facility, a mechanism to help fragile African states consolidate peace, build resilient institutions, stabilize their economies, and lay the foundations for inclusive growth.

Under the Emergency Agricultural Production Support Project, the grant will support intensified production of maize, potatoes, and sweet potatoes through the use of climate resilient certified seeds and varieties. The funding will also help boost poultry production and the supply of eggs and chicken for consumption.

Agricultural producers in the country will receive 270 tons of maize and potato seeds and 300,000 sweet potato vines. They will also receive 75 tons each of DAP binary fertilizer, NPK (nitrogen, phosphorus, and potassium) fertilizer and urea fertilizer, as well as phytosanitary products.

Under the project, farmers will also take delivery of four tractors and 20 power tillers. Sixteen laying and broiler houses will be built to house 160,000 day-old chicks (broiler and laying). About 10,780 producers will receive training in the production, processing and conservation of maize, potatoes, and sweet potatoes. Further, 3,220 poultry farmers will be trained in breeding techniques and poultry management. Lastly, the project will establish a guarantee fund for producers of agricultural inputs and feed importers.

More than 14,000 households, about 70,000 people, living on the country’s three islands—Grande-Comoros, Anjouan and Mohéli – will benefit from the project. Beneficiaries are covered by a dozen rural economic development centres and 400 professional agricultural organizations, 55% of which are owned by women.

To address the impact of rising food prices resulting from the war in Ukraine, the Board of Directors of the African Development Bank Group on 20 May 2022 approved a $1.5 billion African Emergency Food Production Facility. It has begun providing quality seeds (wheat, rice, maize, and soybean), fertilizers and other support services to 20 million farmers across Africa. The goal is to produce an additional 38 million tons of food over the next two years, with an estimated $12 billion value.

Africa growth/start-up research: Private equity and VC professionals say improved connectivity and digital skills are key to African start-ups

- More than four out of five VC and private equity investors expect an entrepreneurial boom in the next three years and 81% believe the value of start-ups will more than double

- 60% warn lack of digital skills is holding back start-ups while 42% expect dramatic improvements in internet connectivity

Venture capital (VC) and private equity investors are predicting an entrepreneurial boom in Africa but warn a lack of digital skills and poor internet connectivity is holding back start-up businesses on the continent, new research for blockchain-based mobile network operator World Mobile shows (please see the attached press release).

More than four out of five (81%) of senior executives at venture capital and private equity companies questioned predict a rise in entrepreneurialism in African over the next three years, with nearly half (47%) expecting a dramatic increase.

They believe that if that happens it will feed through into an increase in the value of start-ups on the continent – currently start-ups are valued at around $7.6 billion – around 0.2% of the total $3.8 trillion value of start-ups globally. Failure to improve connectivity, however, will put a brake on growth.

Around 91% of the senior VC and private equity executives questioned across the UK, US, the Middle East, Singapore, Hong Kong, France, and Germany believe that start-up value will more than double over the next five years as long as the business environment continues to improve.

Around six out of 10 (60%) say a lack of digital skills is currently a major block to developing a start-up culture while more than half (53%) warn about limited funding and 25% say poor internet connectivity makes it hard to start new businesses.

They are optimistic about improvements – around two out of five (42%) expect dramatic improvements in internet connectivity while 44% expect slight improvements. Around 78% expect funding to improve and 86% believe the digital skills gap on the continent will close.

More than half of those questioned (52%) believe improvements in internet connectivity will drive the rise in entrepreneurial spirit in Africa while two-thirds (65%) are confident the business environment will continue to improve.